Lately the Ethereum-based prediction market has accepted the challenge of creating a decentralized exchange on top of Ethereum. If exchanges are completely decentralized on a blockchain, the theory goes, they could offer near-real-time, peer-to-peer clearing and settlement with no single point of failure. Cool.

The team responsible for this initiative wrote extensively about the need for an automated market maker. They created a mathematical model that tests a method for adding liquidity as a bot – comp;letely automated.

But there is one little wrinkle. What happens if there was no liquidity in the exchange?

Unfortunately, low liquidity is a natural by-product of new technology. Early adopters are a small group. And because the exchange will be built on a blockchain, the number of active traders could be very small, indeed — as small as one or two traders.

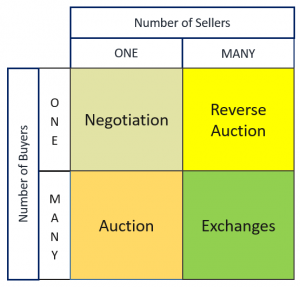

This chart shows the potential for failure if the wrong model is applied to a one-to-one trading situation.

Since inventors are typically ahead of the curve, it is likely that blockchain exchanges will not succeed, initially, due to lack of liquidity. That’s another way of saying: “Nobody will come”. (Cue video of tumbleweed rolling down a deserted main street.)

There is a possible solution. If an exchange can cover all the squares in the matrix, then there is a glimmer of hope.

As developers, we should make many-to-many exchange capabilities a lower priority. Instead, we should concentrate on creating a process of negotiation between a single buyer and a single seller. That’s the logical starting point. Until we solve that problem, blockchain exchanges will be fighting an uphill battle.

One Reply to “Showdown Trades”

Comments are closed.