If we were to allow our users to withdrawal profits earned from trading, we would run the risk of misrepresenting our capabilities. Tradefor is not a gambling site. Nor is it a cryptocurrency exchange. More accurately, we are an entertainment site that provides gamified trading experiences to a social network of game-playing individuals.

In order to eliminate any misinterpretation by regulators as to what we are (a trading game) we limit withdrawals of Ether to a maximum of the amount that you deposit into Tradefor.

All withdraws must be in Ether.

Any profits gained from trading will not be disbursed to traders. Although you can continue to use your increased buying power gained from making profitable trades to trade for new gift cards, you cannot withdraw profits accrued from trading in Tradefor in cash.

Example of permitted withdrawals

Say you deposit 0.05 Ether into Tradefor and you trade your way into a total buying power of 0.08 Ether. At this point, you can withdraw up to 0.05 Ether (the amount you funded yourself) but you cannot withdraw the 0.03 you made in trading profits. Any profits made from good trades will remain in your Tradefor account as increased buying power.

How do I make an Ether withdrawal?

To make fund or withdraw your Tradefor account, first download Metamask. Metamask is a browser extension that only works in Google Chrome or Brave browser. It allows you to interact with smart contracts in the Ethereum blockchain and view your remote Ethereum wallet from sites like MyEtherWallet.

In the Tradefor site, go to “Funding” in the main menu.

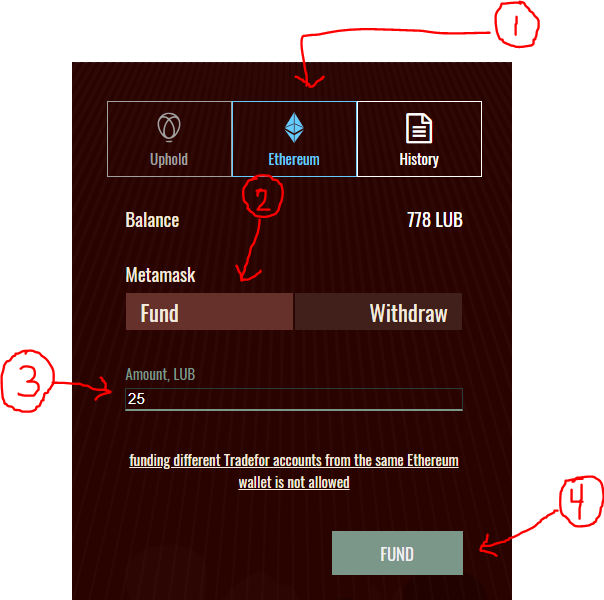

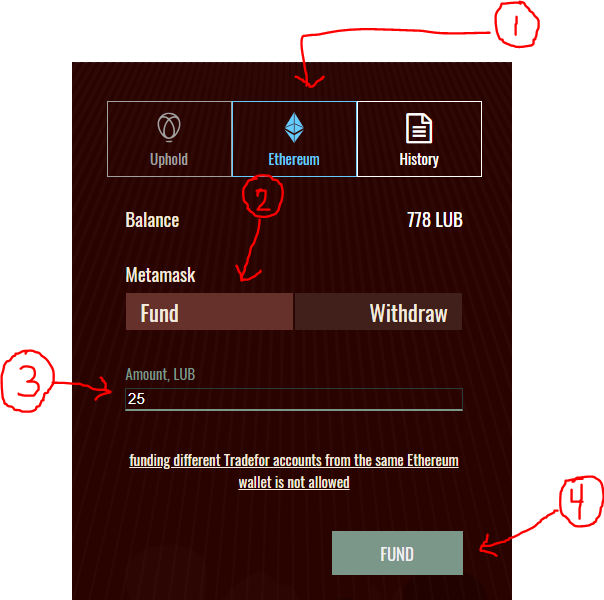

- Then select the “Ethereum” tab

- Select “Fund” tab for deposit. and “Withdraw” tab for a withdrawal

- Enter amount of transfer you want to make. One LUB equals about $0.05.

- Press the “Fund” button

IMPORTANT: You will have to validate your funding request in Metamask before your transaction will process.

Open Metamask and select “Submit”. This will send your request to the smart contract on the Ethereum public blockchain.

In about a minute, your transaction show be updated — both in Tradefor’s site and in your Ethereum wallet.

Here is a video of the process:

Funding with Metamask